The new legislative session will officially begin on January 6, 2026, and the VLCT Advocacy team is excited to tackle some unfinished business and emerging issues in the second half of this biennium. By all accounts it looks like this could be a difficult session. With competing priorities like housing, healthcare, education, property taxes, and transportation fund shortfalls, the affordability agenda will be front and center.

Our advocacy team has spent the summer and fall months engaged in legislative study committees, working groups, rulemaking, and working with members to develop some new and refined policy positions ahead of the session.

In this legislative preview we announce our new 2026 Legislative Priorities, share important updates on the implementation of both the Community and Housing Infrastructure Program (CHIP) and Act 181, review the state government’s FY26 budget forecast, and more.

Vermont’s municipalities need support from the state in meeting the obligations and functions of today's local government and want state government to take action to solve the challenges of the 21st century.

At VLCT’s 2024 Annual Meeting, all present and voting members voted unanimously to adopt the 2025-2026 Municipal Policy. In the 2025 Legislative Wrap-Up, we recapped the major legislative actions from last year, which included some big victories for Vermont municipalities, such as significant expansions to municipal financial authority, a new revolving loan fund for municipal infrastructure, the protection of municipal legal trails, and – last but not least – the greatest investment in infrastructure and housing in Vermont state history, known as CHIP.

To develop our priorities for this session, we considered

- what issues are most urgent and pressing for local communities,

- which policy areas are most likely to be taken up by lawmakers this year, and

- whether VLCT is the right organization to lead the debate.

For several years, the top concern reported by local officials in VLCT member surveys has been the availability and affordability of housing. Our list of legislative priorities includes a number of zoning and land use related legislative actions, as well as a new municipal taxing authority for short-term rentals, brownfields investment, and a request to match state property tax relief with municipal stabilization agreements to support infill-scale housing development.

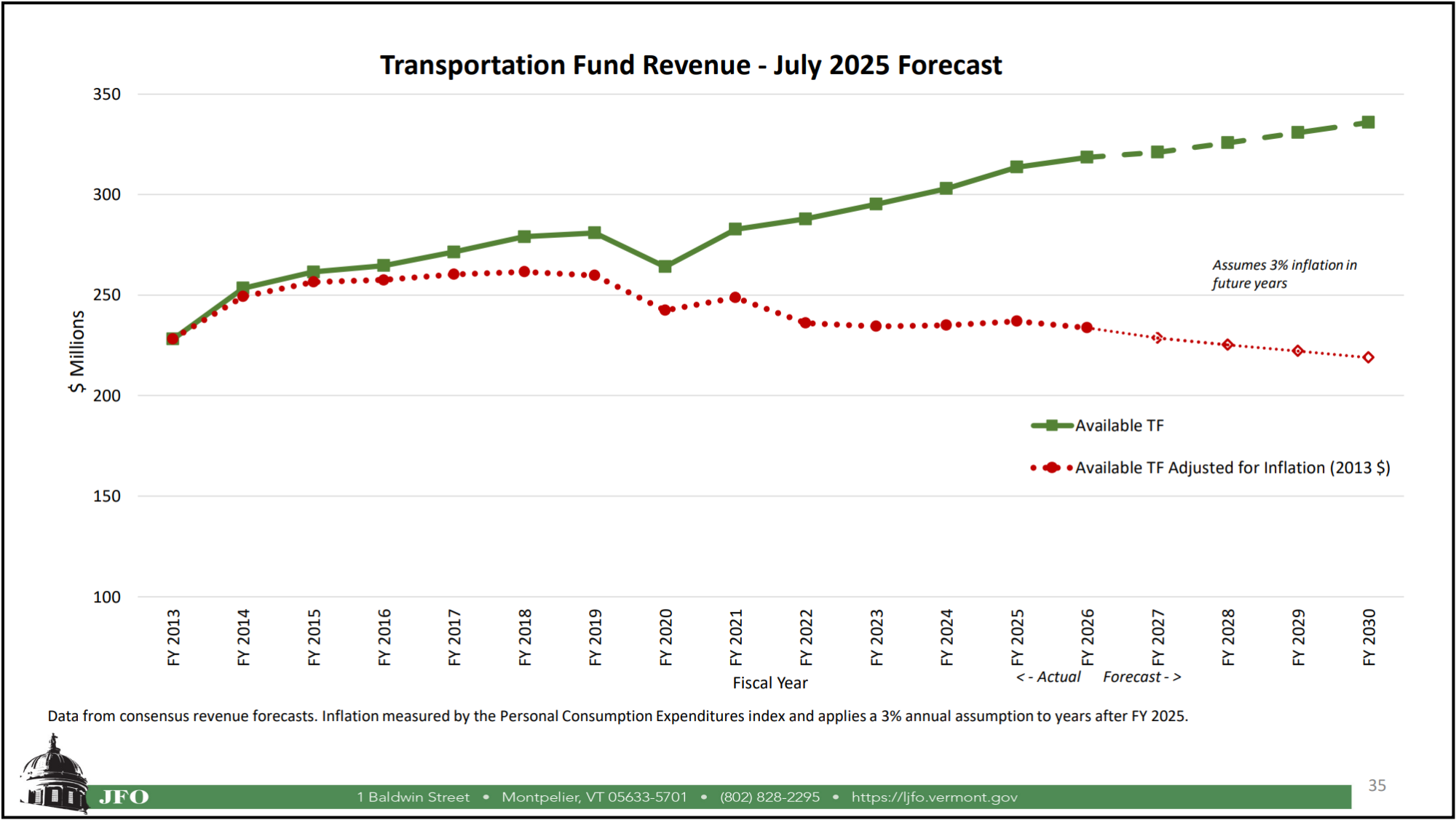

A rising area of concern for local leaders is the perennial funding shortfall within the state transportation budget – which is exacerbated by rapidly rising constructions costs. When adjusted for inflation, transportation fund investments have fallen below 2013 levels. VLCT will be proposing a number of legislative solutions to bolster transportation revenues and to strengthen local investment in roads and bridges.

We will also bring forward a number of proposals to support local law enforcement, improve the state’s delivery of social services, and expand municipal revenue authorities in order to alleviate local property tax burdens.

Find the full list of 2026 Legislative Priorities on our website.

In June, we celebrated the passage and enactment of Act 69, which includes the Community Housing and Infrastructure Program (CHIP).

When implemented, CHIP will be the most significant investment in municipal infrastructure in state history, allowing up to $200 million per year of tax increment financing annually for ten years to be spent by Vermont communities on infrastructure that will serve a public good and support the development of new housing. Over the next decade, CHIP will create thousands and thousands of new homes. Joint Fiscal Office modeling projects that if the program is fully subscribed it could add at least $600 million to the state’s flailing education fund by 2059. CHIP is a new Tax Increment Financing authority for municipalities to fund infrastructure improvements without raising taxes or rates on existing homeowners and renters. CHIP is not a state appropriation or grant.

Per Act 69, the Vermont Economic Progress Council (VEPC) was granted authority and oversight over CHIP and was directed to create rules or guidelines for the program that would meet the statutory requirements. A subcommittee of VEPC convened and met weekly over the summer months to create the new guidelines, with VLCT staff attending and contributing to the subcommittee's discussions. In October, the full council officially adopted the CHIP guidelines that are now posted on the ACCD website. VEPC anticipates that it will be ready to accept the first applications from municipalities for proposed CHIP projects as early as January 2026.

Throughout the last session and during the guideline writing process, the VLCT advocacy team worked hard to make sure that CHIP would be available, effective, and flexible to use for all Vermont municipalities and for any type of housing development. Here are some key elements of the new guidelines that help make CHIP a powerful new tool for communities both large and small:

- Housing Development Site: The definition allows for contiguous parcels under common ownership to be included, or not included, in a CHIP development at the discretion of the municipality. This ensures that the CHIP only captures the tax increment that is required to service the debt and protects future new tax revenue.

- Improvements (infrastructure): A broad and inclusive definition for infrastructure improvements eligible to be financed by CHIP ensures that each municipality can use this new financing tool according to their community's needs and priorities, and with maximum flexibility to support the planned housing development.

- Eligible Related Costs: The definition is expansive and encompasses costs associated with the creation, implementation, and administration of the CHIP site – including costs incurred by a town prior to receiving VEPC approval for the proposed CHIP. Municipalities can use CHIP financing for a broad range of technical and professional services such as design, engineering, project management, financial and project management services, consulting, auditing, and more.

- Public Good: A unique element of CHIP is that, per statute, eligible infrastructure improvements are not restricted to publicly owned facilities. The improvements, however, must enable new housing and must serve a “public good”. VLCT advocated for a workable, objective definition of public good that allows the municipality to demonstrate local need in the case of private infrastructure (for example, private septic systems for a development in a community that does not have a municipal wastewater system)

At the Fall Planning and Zoning Conference in November, the VLCT Advocacy Team provided an overview of CHIP and the new guidelines which you can find at vlct.org/store.

VEPC has arranged a series of webinars to help local leaders understand how tax increment financing works and how it supports community investment. These will take place on January 8, 13, and 15 from 2:00 PM to 3:00 PM, and recordings will be made available. The series explores the steps local municipalities should take to implement CHIP and is designed for first-time learners and local leaders to lay the foundation for responsibly putting this tool into action. Register online here.

VLCT was recently awarded significant funding through the Northern Borders Regional Commission (NBRC)’s Catalyst Program to establish a technical assistance program to build capacity for municipalities to access the Community Housing & Infrastructure Program (CHIP). Through this new program, named CHIP Invest Now VT (CHIP IN VT), VLCT will provide training, resources, and consulting to support infrastructure investments that enable housing development. CHIP IN VT will help ensure equitable access to CHIP funding for municipalities across Vermont. Once our grant agreement is inked, we will be ready to launch in the first half of 2026!

Act 181 of 2024 created the Land Use Review Board (formerly the Act 250 Board) and directed the board to make rules and implement sweeping, statewide land use policy changes.

Since the board was seated, members have been hard at work under three critical statutory deadlines related to Act 181 Implementation for location-based jurisdiction of Act 250:

- Tier 1A Approval Guidelines: A finalized draft of the Tier 1A Applications Guidance will be considered by the Board on December 22. The guidelines shall take effect by January 2026.

- Tier 2 Recommendations Report: Due February 2026, and the LURB is requesting an extension to September 2026. Tier 2 encompasses all areas that are not Tier 1 or Tier 3. The report submitted by the LURB will recommend statutory changes to address (a) the fragmentation of rural and working lands while allowing for development and (b) how to apply location-based jurisdiction to Tier2 areas while meeting the statewide planning goals and addressing commercial development.

- Tier 3 Rulemaking & Report: Report Due September 2026. Act 250 jurisdiction in Tier 3 areas will begin on December 31, 2026. The final rule will determine what parts of Vermont are subject to the new jurisdiction, and whether any exemptions will apply – such as for septic systems, drinking water systems, improvements to existing structures, etc.

There is a fourth new Act 250 jurisdiction which takes effect this coming July called “the road rule”. The road rule will trigger Act 250 review for any construction that happens more than 800 feet from an existing road, or where a combined 2,000 or more feet of new road and new driveway is required. The LURB is expected to write guidance for the implementation of the road rule before it takes effect. The guidance should provide clarity to municipalities and homeowners on how to interpret the rule. Regardless, this creates a massive new jurisdictional trigger for Act 250 that could affect areas of Vermont that are currently light density residential neighborhoods and/or that are transitional and planned for future growth.

Pursuant to Act 181, the current temporary Act 250 exemptions will expire in roughly one year from now – on January 1, 2027 – at which time the new location-based jurisdiction system should be established.

Together, the road rule and Tier 3 could dramatically expand Act 250 jurisdiction.

The road rule applies Act 250 (as intended) to existing forest blocks and encourages new development to happen within 800 feet of an existing road. Tier 3, on the other hand, regulates “habitat connectors” by creating new jurisdictional areas around roads where the majority of land on both sides has tree cover and is considered a high priority forest connectivity block (per Vermont Conservation Design). This potential new Tier 3 area includes significant stretches of state highway and Class 2 roads, including areas where the state highway serves as a main street. So, yes, you read that right – the Road Rule and Tier 3 create new jurisdiction away from existing roads as well as along roads.

Furthermore, the LURB’s Tier 3 rule will determine what types of development in these areas will require an Act 250 permit. The final rule could extend jurisdiction to include:

- Improvements to existing structures – commercial, industrial, and residential including ADUs. The current draft exempts only construction with a total footprint under 200 square feet or within 50 feet of an existing structure.

- New construction of wastewater treatment and drinking water systems (septic systems and wells).

- Construction of new residential, commercial, or industrial structures including single-family homes regardless of parcel acreage.

- Construction or improvements for transportation and utility purposes. The current draft exempts only those that are entirely within 50 feet in any direction of roads.

- Construction or improvements to trails. The current draft exempts only new trails less than 100 feet in length, or maintenance of an existing trail within 10 feet.

You can read the current draft Tier 3 rule 2.1 here, and use the Tier 3 map viewer to see how the new jurisdictional areas may apply to your community.

The breadth of this new authority and the estimated area affected by the new jurisdiction have raised serious concerns among stakeholders related to equity, transparency, and whether the draft rule supports the intent of Act 181 to encourage a density of new housing along existing public infrastructure (such as roads). Many realtors and municipal officials have raised concerns over how property values and grand lists may drop over time due to the added costs and burdens associated with Act 250 permitting. Lawmakers, notably including the leaders of the Rural Caucus, have become alarmed by the lack of community engagement and outreach as the road rule effective date approaches. Many planning and zoning officials have expressed confusion about how the road rule should be interpreted and are unsure about how to treat projects that may be permitted locally, but not under construction, before next January.

These are all questions that must be answered before such a sweeping regulatory change takes effect. VLCT is joining rural leaders, law makers, and other organizations to call for a slowdown of Act 181 implementation. Our 2026 legislative priorities include:

- Further limit municipal appeals of housing projects within Tier 1 areas

- Extend temporary Act 250 exemptions

- Delay implementation of the Road Rule and Tier 3 jurisdiction

- Eliminate requirements for municipal enforcement of existing Act 250 permits within Tier 1A areas

VLCT supports a bill planned to be introduced by the Rural Caucus that would address our primary concerns and would also require the LURB to notify all property owners within a proposed Tier 3 area at least 30 days prior to a public hearing on the Tier 3 Rule.

Earlier this month, VLCT hosted a training on Act 181 Implementation and the Road Rule to help municipal leaders understand which areas of their community may be affected. The webinar was presented by LURB members Kristen Sultan and Alex Weinhagen. you can find it online here.

For a long time, the conventional wisdom was that farms subject to the state’s Required Agriculture Practices (RAPs) were afforded a broad exemption from municipal zoning regulation. However, in May of this year the Vermont Supreme Court issued a decision that appears to dramatically change the landscape of municipal zoning in terms of the scope of the agricultural exemption for certain activities and structures.

The decision overrules an Environmental Division of Superior Court determination that an Essex Junction man’s duck-raising and cannabis-cultivation operations were exempt from municipal regulation under state law. The Court held that the law “does not prohibit all municipal regulation of farming if that farming is subject to the RAPs Rule,” instead saying that the law only “prohibits municipal regulation of ‘required agricultural practices,’ or the agricultural land-management standards intended to protect Vermont’s waters.”

As a result of the court’s decision, we anticipate legislative action in the 2026 legislative session to clarify the legislature’s intent and to redraw the bounds of municipal authority over agricultural practices.

The VLCT advocacy team agrees that the time is right to rebalance state and local authority over certain types of agricultural practices, as various state, regional, and local entities work through the implementation of sweeping land use regulatory reforms from the HOME Act of 2023 and Act 181 of 2024. Together, those laws created new statewide and local housing targets, municipal preemptions, and a process for the location-based jurisdiction of Act 250.

At its November meeting, the VLCT Board of Directors voted to amend the 2025-2026 Municipal Policy to adopt a new approach to agricultural zoning that we hope will protect our working lands, support Vermont farmers, and enable smart growth in our village centers and downtowns.

The updated 2025-2026 Municipal Policy will state “To reduce conflicts with state, regional, and local goals for housing development, municipalities should have the authority to regulate agricultural operations in approved Tier 1A and Tier 1B areas or areas where municipalities have voted to support a state designation. Municipalities support a state-led regulatory approach to agriculture outside of these areas."

The current estimates for future Act 250-exempt areas in Tier 1A and Tier 1B range from 2% to 3% of the state’s land area, pending the ongoing regional mapping and LURB approval process. If the legislature supports VLCT’s proposal, the effect would be that in the vast majority of the state’s land area farming operations would remain fully exempt from both state and local land use regulations – but in the smallest, densest areas, where communities have determined that housing and commercial development should occur, municipal ordinances would apply to farming as they do for all other businesses and industries.

The Tier 1 areas represent existing residential neighborhoods and mixed-use commercial districts served by municipal water and sewers along major state transportation corridors that are generally within regional job sheds. To create an Act 250-exempt area, the municipality must navigate months or years of local, regional, and state processes that accommodate broad public input and numerous actions of the municipal legislative body. The municipality must meet stringent statutory criteria for capital planning and capacity, historic settlement patterns, and a high regulatory standard. Most importantly, the municipality must demonstrate a community-driven plan for growth that aligns with state and regional goals for housing.

In these small growth centers, municipalities must have the broad regulatory power necessary to realize the type of development their community needs, envisions, and allows for in local ordinance. This session, VLCT will advocate to exempt agricultural activity from municipal regulation, except for in Act 250-exempted areas, as part of our pro-housing legislative agenda.

On December 3, lawmakers gathered in Montpelier to receive their annual pre-session legislative briefing presented by the Joint Fiscal Office. The news was good, bad, and downright ugly. Senate Pro Tem Phil Baruth began the day saying, “this session will be more like a horror movie than a Hallmark holiday film”. He delivered a round rebuke of federal policies on trade, domestic economic policy, social programs, immigration, and disaster relief which he called “an attempt to bend Vermont to a cruel federal will”.

Legislative economists began the briefing with a review of state revenue performance, which is relatively stable, and provided a damning analysis of federal tariff impacts.

The state general fund is up 1.5% over the year-to-date targets, with the transportation fund and education fund down 2.3% and 0.1% respectively. Increased revenues were largely seen in personal income taxes collected.

Despite relative stability in the local economy, the affordability crisis facing Vermont families has worsened seriously, with some people suggesting it is partially due to the Trump tariff increases which JFO reports have “reversed the decline in the rate of inflation, causing the Fed to delay interest rate cuts, slowed job growth and caused prices for food and other essential items to rise”. Since January, the current average tariff rate of 16.8% has resulted in a loss of about $1,700 per average American household and $900 for households at the bottom of the income distribution.

No surprise to anyone, the cost of housing in Vermont continues to rise. Home prices in the Burlington metro area increased from last year to 99% of the prior peak (meaning as high as ever) while statewide the cost to purchase a home has flattened but remains at 79% of prior peak pricing.

In summary, amidst a volatile national economic year Vermonters have kept buying things, and those things are costing them more and more money.

Harkening back to Senator Baruth’s opening remarks, the Joint Fiscal Office (JFO)’s preview of the state Transportation Fund (T-fund) is more than a little spooky.

Over the last five years, transportation revenues have declined incrementally while costs have skyrocketed to such an extent that today the fund has less purchasing power than in 2013. This chronic underfunding of critical state and local infrastructure will only compound in future years. The Agency of Transportation forecasts that if current funding levels are maintained, more than 60% of Vermont pavement will be rated in poor or very poor condition by 2030.

Transportation Fund revenues are below FY25 year-to-date projections and are expected to drop further in future budget years.

JFO estimates a 1.33% compound annual growth rate in Transportation Fund revenues between 2026 and 2030 – which is far below expected inflation and likely to cost the T-fund tens of millions of dollars over the next four years. These declining revenues are largely driven by decreased purchase and use taxes (Vermonters are buying fewer cars) as well as improved fuel efficiency and adoption of electric and hybrid vehicles (Vermonters are buying less gasoline).

Transportation funding has been a simmering issue for years – but it’s about to explode.

That is because the majority of the state’s annual investment in roads, bridges, and pedestrian infrastructure doesn’t really come from state revenues – it comes from federal grants. The T-fund is really more of a piggy bank than a checking account, storing state revenues generated by the purchase, registration, and fueling of Vermonter-owned vehicles and using that money to draw down federal grants at a matching rate of roughly 2:1.

The current FY27 budget shortfall of $33 million puts $163 million of anticipated federal funding at risk. In FY28, the deficit is projected to increase to $35 million, threatening $170.8 million.

VLCT is seriously concerned. Given the dollar-to-dollar value of federal transportation programs, state-only funded programs will be first up on chopping block – which includes town highways and structures.

Every fall, several new reports are published by legislative working groups, committees, state agencies and boards, and the non-partisan Joint Fiscal Office. These reports provide the factual and fiscal foundation for much of the State House debate around new legislative proposals.

Here are some recently released reports we are interested in, as well as some recent reporting from local press related to top issues for local government.

- Brownfields Process Improvement Report from the Agency of Natural Resources Department of Environmental Conservation

- Act 250 Appeals Study Report from the Land Use Review Board (LURB)

(includes recommendation for the LURB to hear municipal zoning appeals for housing developments in Tier 1a or Tier1b areas)

- Multi-District Audit of Voter Checklists Report from the Vermont Secretary of State

- Vermonters Projected to See Nearly 12% Hike in Property Taxes Next Year – article by Vermont Public

- 10 Things To Know About Act 73, Vermont’s Education Reform Law – article by VT Digger

- Gov. Phil Scott Signs Executive Order Aimed at Boosting Housing Production – article by VT Digger

- Vermont Poured Hundreds of Millions of Dollars Into Housing During the Pandemic. What Has It Built? – article by Vermont Public

- Vermont Towns Struggle With Homelessness Without State Help – article by Seven Days

Once the State House doors open on the new session, the most important key to our success will be your input and participation in VLCT’s advocacy work. Don’t forget to register to attend our first Advocacy Chat of the session, which will be held on Monday, December 15 at 1 PM via Zoom. Register here for the Advocacy Chat Preview of 2026.

- You can find (and share) this legislative preview, last month’s advocacy update, and future reports and alerts on our main Advocacy webpage.

- Check our Effective Testimony Guide for best practices with legislators and answers to frequently asked questions before you visit the State House.

- To support VLCT’s advocacy work; participate in policy development, testimony, and legislative actions; or just learn more, reach out to Josh and Samantha by email at jhanford@vlct.org and ssheehan@vlct.org.