Testimony to the Senate Committee on Government Operations

Regarding Municipal Unassigned Fund Balance Authority

Josh Hanford, Director of Intergovernmental Relations, VLCT

Samantha Sheehan, Municipal Policy and Advocacy Specialist, VLCT

January 8, 2026

Act 57 of 2025 “The Flood Bill”

The Flood Bill included several actions targeting support to municipalities to enable the preparation, emergency response, and recovery from flood disasters and other all hazard events and changed the LOT withholding formula from 70/30 to 75/25.

- Act 57 also enacted three new municipal finance authorities which were jointly developed and recommended by VLCT and the Vermont Bond Bank.

- Section 6: Unassigned Fund Balance

- Section 7: Emergency Borrowing; all-hazard event or state emergency

- Section 8: Denominations; Payments; Interest (level debt service)

Types of “Fund Balances” Used in Governmental Finance

Think of these more like an adjective…..less like a budget line or bank account.

- Restricted: resources that can only be used for specific purposes dictated by external parties (like grants or laws). In the municipal context, this can include charters. TIF revenue is an example of restricted funds.

- Committed: resources set aside for specific purposes by the municipal legislative body requiring the same level of formal action (typically ordinance) to change or remove the commitment. Housing Trust Funds are a common example of committed funds.

- Assigned: resources intended for a specific purpose, but not legally constrained. For example, recreational program revenues retained for same future purpose (this year’s parade registrations pay for next year’s parade).

- Unassigned: the leftover, spendable amount in the General Fund after accounting for restricted, committed, and assigned funds.

Definition of a “Fund Balance”

Fund balance is a key component of municipal financial management, providing resources that help manage risk, stabilize tax rates, and maintain services.

- Fund balance is the mathematical difference between assets and liabilities in a governmental fund, resulting in a surplus or deficit.

- It is not a cash account and should not be equated with a municipality’s bank balance.

- Fund balance reflects the financial position of a municipality and helps indicate overall financial health.

- Fund balance is reported in accordance with Generally Accepted Accounting Principles (GAAP) and GASB Statement No. 54, which classifies fund balance based on legal and policy constraints.

Definition of an “Unassigned Fund Balance”

An Unassigned Fund Balance is not excess money accumulated unnecessarily to reduce or “buy down” taxes.

- Is the residual category of the General Fund.

- Represents resources available for general governmental purposes.

- Is not restricted, committed, assigned, or non-spendable.

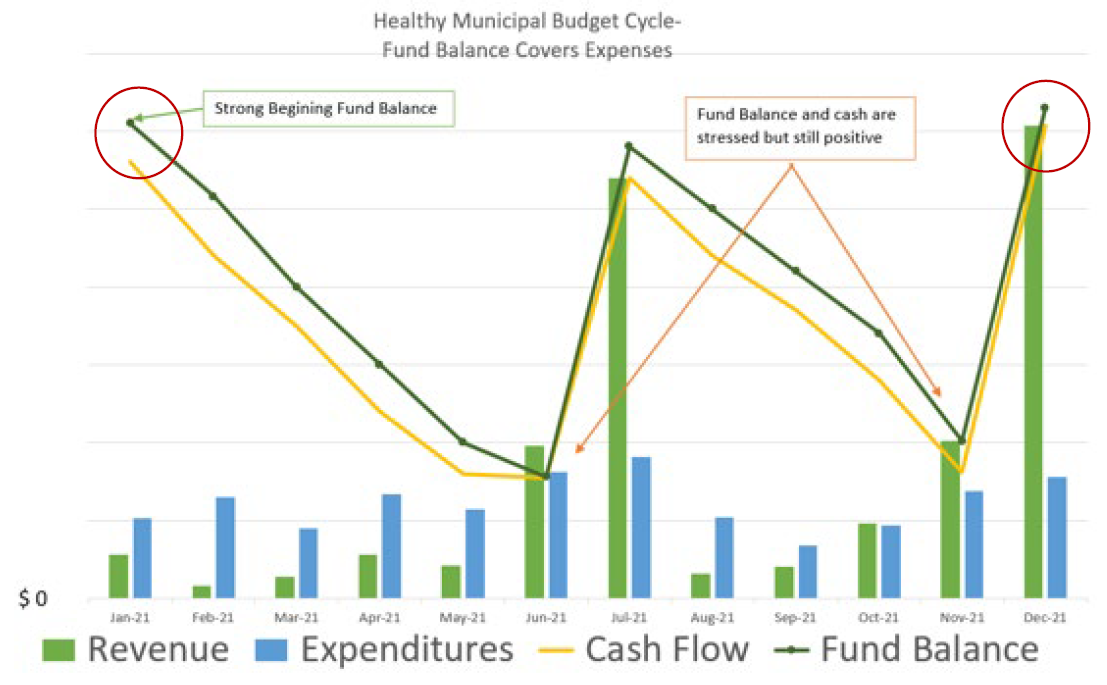

Adequate fund balance allows the municipality to continue public services during periods of constrained cash flow (before propertytax payments) without relying on short term debts such as a Tax Anticipation Note (TAN).

Image from New Hampshire Municipal Alliance

How Does It Work?

Act 57 grants the municipal legislative body control over these funds without additional voter approval.

Selectboards are encouraged to adopt a formal fund balance policy that:

- Defines target fund balance levels (such as a percentage of the GF; VLCT recommends 15-17%)

- Establishes conditions for use and replenishment

- Identifies corrective actions if fund balance falls below targets.

- Addresses treatment of excess fund balance (e.g., one-time uses, capital needs, tax stabilization).

Fund balance levels should be reviewed regularly and adjusted based on:

- Economic conditions.

- Revenue and expenditure patterns.

- Debt obligations.

- Identified financial and operational risks.

Benefits of Maintaining a Healthy Unassigned Fund Balance

Municipal cash flow is uneven, with expenses incurred year-round and revenues collected at specific times. In Vermont, municipal revenue authorities are very limited, and most municipalities rely primarily on municipal property taxes.

- Supports stable and predictable tax rates over time.

- Provides flexibility to respond to emergencies, economic downturns, and unforeseen events.

- Ensures sufficient cash flow during periods when revenues are not yet collected.

- Reduces or eliminates the need for short-term, emergency borrowing and associated interest costs.

- Strengthens credit ratings and lowers interest rates for borrowing. From Moody’s Investors Service, “a fund balance between 15% and 30% of revenues is needed to receive a scorecard value of “Aa.”

What Else Should Vermonters Know About Unassigned Fund Balances?

- The State of Vermont, like all 50 states, maintains a very healthy fund balance which contributes to our excellent state credit rating.

- Maintaining a UAF is a prudent fiscal practice recommended by governmental finance organizations and auditors. The

Governmental Finance Offers Association (GFOA) says “It is essential that governments maintain adequate levels of fund balance to mitigate current and future risks.” - Actions by the legislative body to maintain or expend funds are subject to all normal requirements of the law (such as public records law, open meeting law, ethics law), policies of the town, and rules adopted by the body.

- Act 57 created this new authority and does not require towns to use it ... but they should!

What’s Next?

The Unassigned Fund Balance authority created by Act 57 became effective July 1, 2025.

- Town Meeting Day 2026 will be the first opportunity for many municipalities to utilize this new authority for their fiscal year 2027 budget.

- VLCT will soon issue a new model Fund Balance Policy with guidance, available to all Vermont municipalities.

- All members may consult with VLCT’s Municipal Operations Support team for questions, concerns, and assistance in establishing an unassigned fund balance and/or adopting a governing policy.

Links and Resources

“Fund Balance Guidelines for the General Fund” Government Finance Officers by GFOA

Taking the Mystery Out of Fund Balance, New Hampshire Municipal Association

Moody’s Rating Methodology, US Local Government General Obligation Debt

Example fund balance policy, City of Burlington