Testimony to the House Ways and Means Committee

Regarding Proposed CHIP Funding

Josh Hanford, Director of Intergovernmental Affairs

Samantha Sheehan, Municipal Policy and Advocacy Specialist

May 1, 2025

How Does a Grand List Grow?

To understand the benefit of tax increment financing programs we must understand grand list growth.

Understanding Grand List Growth

To assess background growth for the purpose of analyzing the potential impacts of tax increment financing programs, it is problematic to include grand list growth from revaluation. Revaluation is tax revenue neutral.

- The equalization study (CLA) is a method of revaluation based on current fair market value.

- Revaluation does not change the amount of property tax revenue to the Education Fund.

- Development of new housing increases grand list revenue.

- Real annual municipal grand list growth (unequalized) is understood to generally .8% – 3%.

- Per VHFA, Between 2010-2020 Vermont’s housing stock increased by an average rate of 0.4% (1,178 homes per year).

Example 1: How New Housing Construction Changed Burlington's Grand List Over Time

In 2012, the ten-year average was 61 new units per year. In 2023, this average was 119 units per year – about a 200% increase in rate of development.

Percent of Grand List Growth in Burlington, Controlled for Reappraisal

Even with a substantial, sustained increase in the rate of home building, Burlington has only experienced year-over-year growth of the grand list above 2% one time.

Example 2: Revenue Neutral Reappraisal in Stowe

When Stowe complete a municipality-wide reappraisal in 2024, the grand list value jumped from $2 billion to $5.5 billion. Despite a significant increase that year in the school budget, Stowe’s homestead education property tax rate dropped from 2.43 to 1.33.

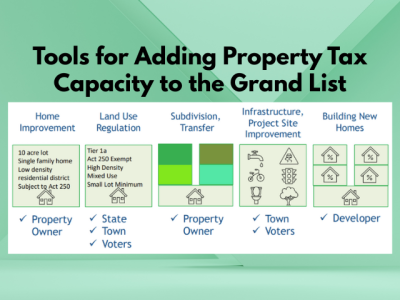

Tools for Adding Property Tax Capacity to the Grand List

Other Non-Property Tax Revenues from Mixed Use Development

The current proposal (CHIP) would require 60% of floor area ratio be housing, 40% could be commercial. Many municipalities require ground floor retail in downtowns.

| Local | State | Education Fund |

| Local Option Taxes | Local Options Taxes | |

| Permit Fees | Income Taxes | |

| Public Parking | Payroll Taxes | |

| User Fees (rec, arts) | Sales and Use Tax | ✓ |

| Water Rates | Meals and Rooms Tax | ✓ |

| Sewer Rates | Property Transfer Tax | |

| Unique municipal fees & taxes | Utility/Fuel Surcharges |

FY26 Education Fund Projected Revenues

Why Do Municipalities Want Tax Increment Financing Programs for Infrastructure?

VLCT supports a new financing authority for municipalities that does not require a "district". The current proposal moving through the legislature is called "CHIP", other proposals have been "Spark", "HIT", "Project Based TIF", and "Performance Based Contracts".

- It does not use any state appropriation

- It does not require and increase in municipal tax rates or water rates

- It grows other non-property tax state and local revenues

- It increases state and local tax capacity by growing the grand list

How is This Different From "Big TIF"?

Project-based TIF proposals are for one or more contiguous parcels that support a single mixed-used development.

- Incentivizes municipality to pay down the debt and take back its own new increment as soon as possible

- Achievable for small, rural, and low-resource communities that are experiencing grand list loss (includes technical assistance)

- Doesn't require long-term, ambitious growth strategy (towns that don't want to "grow" still need to "build")

- The developer or a sponsor can issue the debt; preserves municipal debt capacity, could be more favorable to voters, is faster

Why is Tax Increment Financing Authority Better for Municipalities Than Grants, Tax Credits, Tax Stabilization, or Direct Subsidy? . . . or different?

- It does not use any state appropriation.

- It is an authority of the municipality created by local process.

- It is non-competitive.

- Does not inhibit cash flow; grants require substantial local match be available; OTV revenues are stable.

- Housing-type agnostic; grants and subsidy "string" may be incompatible with local land use law, planning, and need.

- Additional state subsidy is and will be necessary especially for perpetually affordable projects.

- No chicken or egg; land use law and permitting regimes require that infrastructure happen first.