There's a lot going on this week with multiple bills making substantial progress. Read more about what happened this week below, and don't miss our latest advocacy updates to Municipal Capacity, Revenue, and Governance and to Housing, Community Development, and Land Use which include:

- Act 250 and Housing Compromise

- Municipal Tax Abatement and Tax Sales Bill - VLCT requested changes now included

- Municipal Ethics Bill

- The "Big Bill" FY25 Budet Bill

- Miscellaneious Tax Bill

- Communication Taxes and Fees Bill

- Library Modernization Bill

- Unemployment Insurance & Worker's Compensation

This week VLCT provided testimony about:

- Municipal Ethics Bill

- Workers' Compensation Cancer Presumption for Firefighters

- BE Home Act and H.687

- Mental Health Service Guidelines for Municipalities

- Thermal Energy Networks Act

Some of the content of the Weekly Legislative Report below is provided by our advocacy partners. For additional detail and more commentary from VLCT Advocacy staff, visit the Legislative Reports webpage to access our topical Advocacy Updates.

You might be over talking about the eclipse, however, recent estimates put the visitors this weekend at 160,000 coming to our little state of only 645,000, mainly concentrated in the northern half of the state and 50,000 people around Burlington’s Church Street Marketplace. This was a significant boost to our economy and the Vermont Brand during a normally quiet time of year. Relatively few issues have been reported, yes there was backed-up traffic but that can be expected when you put an additional 60,000 cars on the road in a short period. So, when you think back on the eclipse, remember the natural wonder and community you experienced, but also think about what it would look like if some of those visitors were a permanent part of your community. Would your community benefit from more kids in your schools, would your community benefit from more taxpayers, how could we accommodate them without impacts to our natural environment?

With school budget votes still happening across the state and some budgets still failing, the House Ways and Means Committee has what they need to move forward with the yield bill, which sets the statewide property tax rate, this year.

- Currently, 27 failed, 3 defeated again, 65 passed, 17 late votes, and 6 rewarned budgets add up to about $192 million in additional expenses.

- The yield bill envisioned some major, necessary changes over the next two fiscal years, however, it has since been scaled back due to pushback from colleagues, as well as associations of school administrators.

As we write this, many elements of the proposed yield bill are imploding, however, what is almost certain is the non-homestead rate will be increased to 18.57% which will be a $1.449 tax rate while the homestead yield is 15.54%.

- This represents a shift of $25 million to the non-homestead payers which includes businesses and renters, due to non-homestead dollars subsidizing the property tax credit, which income sensitizes homeowners. However, the shift to non-homestead payers is counter to the goals expressed by many lawmakers, " to tie voters' decisions to their tax rates more closely".

The Big Controversy:

The bill, as drafted earlier this week, would push Vermont to what could be referred to as a foundational funding system in which the state education fund guarantees districts with a base payment per student, or “educational opportunity payments.” From there, the legislature drives down the yield number to make getting a statewide education fund dollar, which requires more dollars from local homestead property taxpayers.

- The Vermont Principals’ Association, Vermont Superintendents Association, Vermont School Boards Association, and Vermont Association of School Business Officials pushed back on this concept because they fear that local voters would vote down more school budgets.

Other Components of the Bill:

- The bill will certainly contain a tax on any internet-based service that is not already taxed, including anything from websites to QuickBooks.

- The bill likely contains a “net asset attestation,” which would preclude those of high value yet with low income from accessing the income sensitivity program.

- The Committee is still considering the creation of a short-term rental surcharge, though not at the previously considered 10%, and more likely at around 1.5 to 3%.

- The bill considers a “variable excess spending threshold” similar to the allowable growth rates in Act 46.

- Also contemplated is new language that would standardize ballot language for school budgets.

- The Committee has wrestled with a way to prevent schools from drawing down statewide dollars to their local budgets which then end up in reserves, something that may not be remedied this year.

- The Tax Department shared a slide deck regarding the steps being taken to address CLA transparency and volatility, including moving to a 6-year reappraisal cycle.

- The Education Committees plan to include language in the yield bill to create a non-legislative task force of education experts and stakeholders. This task force will be charged with defining the goals and vision for public education in Vermont and mapping out a timeline and process for redesigning the education system and its financing.

The Vermont House recently passed S.25, a bill aimed at regulating various products containing harmful chemicals, particularly focusing on perfluoroalkyl and polyfluoroalkyl substances (PFAS), building upon a previous law, S.20, which banned PFAS in several items such as firefighting foam and food packaging.

- The expanded scope of S.25 includes regulations on cosmetics, menstrual products, textiles, athletic turf fields, cookware, and products marketed to children like toys and diapers with the goal of reducing exposure to PFAS and other chemicals while aligning Vermont’s regulations with other states like California to have a broader market impact.

- The bill also proposes collaboration among different state agencies to develop a systematic approach to addressing PFAS across various consumer products.

- A floor amendment was made to ensure the regulations wouldn’t overly burden Vermont cosmetics companies while still increasing regulation.

- Specifically, S.25 bans the sale, manufacture, or distribution of products containing PFAS, including cookware, food packaging, adult diapers, juvenile products, and textiles, with most bans taking effect in 2026.

- Additionally, S.25 incorporates S.197, which tasks the Agency of Natural Resources with proposing a program to identify and restrict consumer products containing PFAS. This program aims to address public health and environmental concerns, outline manufacturer responsibilities regarding PFAS disclosure, and incorporate best practices from other states. The implementation plan is due to the legislature by November 1st.

The Senate Committee on Natural Resources is working on H.687 and S.311 with the goal of getting a consolidation of the two out next Tuesday. Read VLCT's testimony and see VLCT's latest advocacy updates to Capacity, Revenue and Governance, and to Housing, Community Development, and Land Use for more.

- The prevailing thought is that the interim regulatory framework of S.311 would be implemented along with the long-term changes of H.687.

- Both bills incorporated the tiered jurisdiction of Act 250, however, S.311 would have been less prescriptive and lean on non-legislative work to craft those tiers ultimately.

One area of contention is that of appeals and governance:

- The Senate Committee on Economic Development, Housing, and General Affairs focused on the section of H.687 that transfers Act 250 permit appeals from the Superior Court to a new board. Committee members were concerned that this change would revert the process back to a two-track system of appeals, one for municipal permits and another for Act 250. Many proponents of the changes counter that very few municipal and Act 250 permits were “consolidated” at the court level; more often, they are “coordinated” in terms of the timing of appeals.

- The Chair of the Natural Resource Board provided an implementation timeline suggesting it could be five years before a new board would be ready to take on permit appeals.

Components outside of Act 250:

- As S.311 is a housing bill, there is a great deal in the bill that is not contemplated in H.687, such as S.100 municipal zoning clarifications (which VLCT opposed and requested practical changes to be feasible), tax credits, taxes, housing programs, rental data collection, short-term rentals, flood risk disclosure, mobile homes, age-restricted housing, and reports and studies

- The Senate seems ready to reject a $140 million piece of housing legislation, H.829, which was previously sent to them by the House. This week, the Chair of the Senate Committee on Economic Development, Housing, and General Affairs explained to her caucus that the state has invested $500 million into housing over the last two years and that regulatory reform is the most essential component now.

- That bill would have pushed tax rates for Vermont’s upper-income brackets, starting at $410,000 for single filers and $500,000 for those married filing jointly, to some of the highest in the country and dramatically increased the property transfer tax.

The House and Senate Judiciary Committees are each still working away on bills related to public safety.

- The House is contemplating S.195 this week, which was sent to them by the Senate and would create more pretrial components to protect public safety.

- The Senate is also contemplating legislation sent to them by the House, including auto theft, retail theft, and the complexity of sealing and expungement.

An area of concern that could possibly be the subject of a veto is the justice system investment made in H.880, which seeks to address the state’s court backlog of over 16,000 cases in the judicial system by creating 70 new positions funded through higher corporate taxes and fees.

- Governor Scott has pushed back on the legislation, as he sees it as merely throwing money at the problem, preferring policy changes instead.

- House Legislators push back, pointing to the need for timely case disposal to enhance public safety.

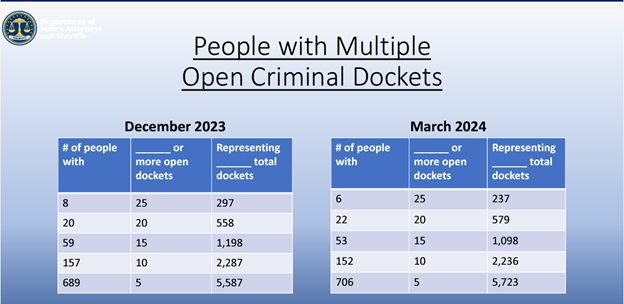

- The House Committee on Judiciary heard from the Department of States Attorneys, in the context of S.195, that nearly 60% (58.68%) of pending criminal dockets involve persons with two or more dockets—alleged to have committed repeated criminal conduct (a docket may, typically, include multiple individual counts).

Frustration is growing among House members as they observe stakeholders engage with their work product in the Senate. This frustration is coalescing in some expected amendments as the Senate seeks to strike a balance between business needs and consumer data privacy protections.

- The Chair of the Senate Committee on Economic Development, Housing, and General Affairs told her caucus this week that her Committee is not planning to weaken the data collection section but is concerned about requirements for Vermont businesses that would put them up against a private right of action.

- Witnesses testified to concerns around the Private Right of Action, which would make the state an outlier and could encourage a sue-to-settle model.

- In an attempt to ease these fears, language was floated that would prevent class action suits; however, this would still allow groups of plaintiffs to work together.

- A Health Care Coalition, Blue Cross Blue Shield of Vermont, and Planned Parenthood have raised separate concerns, which the Senate Health and Welfare Committee will need to review and address.

Hundreds of hours of committee discussion each week culminate in our advocacy update, so not everything makes it into the overall update; however, we often cover what is left on the cutting-room floor here for our most dedicated readers.

- Read updates from Week 1, Week 2, Week 3, Week 4, Week 5, Week 6, Week 7, Week 8, Week 9, Week 10, Week 11, Week 12, Week 13, and the last session’s recap.

- The Senate this week conceded it would not attempt to override the veto of the flavored tobacco bill, S.18. The bill would have put a roughly $15 million dollar hole in the state budget, which appropriators will now no longer need to be concerned with.

- The Senate Committee on Economic Development, Housing, and General Affairs has a new draft of H.10, a bill making changes to the Vermont Employment Growth Incentive program. The new draft repeals the sunset on the program and amends the frequency of a strategic evaluation process from an annual task to a five-year cycle. The bill still contains a track that allows for a forgivable loan option for the VEGI program to be administered by VEDA.

- The reporting and remittance of the new payroll and self-employment payroll tax will begin on July 1, 2024. The Vermont Department of Taxes has produced a video and guide outlining the Child Care Contribution (CCC) and what employers need to decide before July 1. Download the Vermont Child Care Contribution Guide and watch this video to learn more.