The ARPA Closeout Process Is Starting....

Treasury has begun the early closeout process for ARPA recipients. At this stage, only recipients specifically invited by Treasury may close out their ARPA award. On September 10, 2025, around 100 municipalities across the country received invitations. Municipalities can begin preparing for the eventuality of this process by reviewing this checklist.

If you were or are notified by Treasury for early closeout, please let us know! (email kbuckley@vlct.org)

Link to Treasury's reporting portal:

https://portal.treasury.gov/compliance

Visit our ARPA: Compliance and Reporting page for more information on gaining access to Treasury's reporting portal and compliance and reporting requirements.

The deadline to obligate your ARPA funds has passed. The next deadline to expend your obligated ARPA funds is December 31, 2026.

ARPA: Single Audit? Or Alternative Compliance Examination Engagement (ACEE)?

If your professional auditor is not familiar with the nuances of your local ARPA award, please share this Resource item with them.

About ARPA

The American Rescue Plan Act of 2021 established the Coronavirus State and Local Fiscal Recovery Fund (CSLFRF, aka ARPA) which provides $350 billion to state and local governments for the response to and recovery from the COVID-19 pandemic. Of Vermont’s $1.25 billion share, over $200 million was allocated to municipalities.

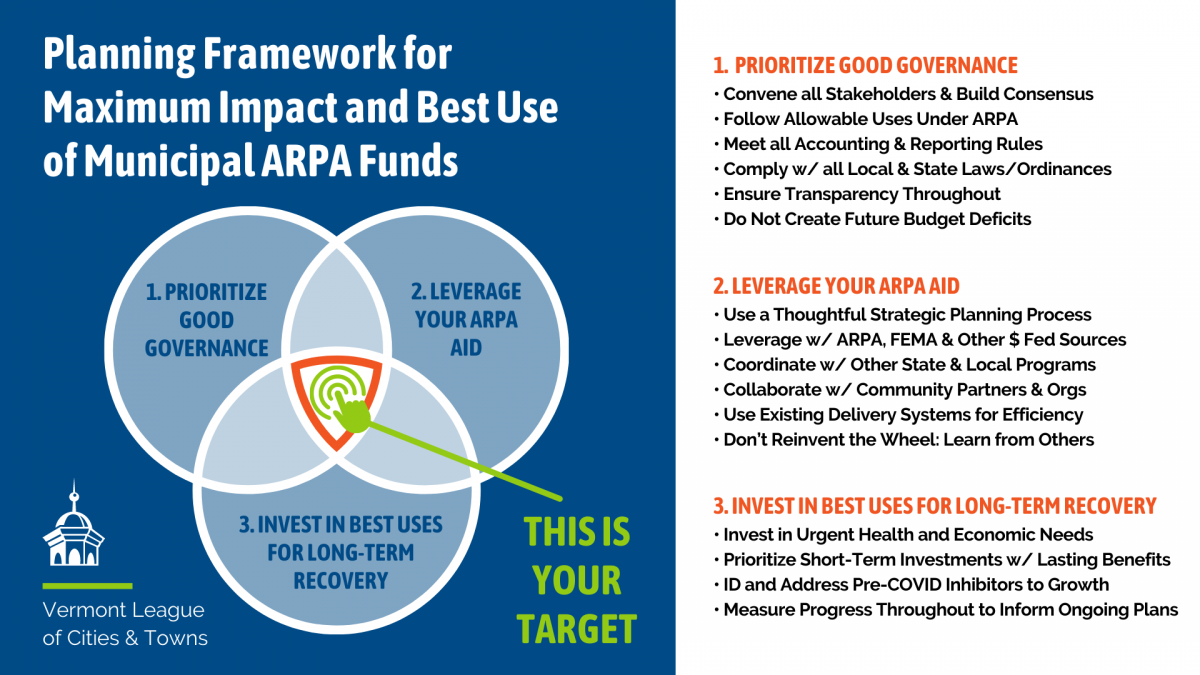

Legislative bodies have discretion and flexibility over how to spend their local ARPA funds. VLCT encourages its members to take their time, be thoughtful, and plan strategically.

VLCT extends our thanks to the Vermont Legislature and Governor Phil Scott. Their support allowed VLCT to establish the ARPA Assistance and Coordination Program to support Vermont’s towns, cities, and villages that chose to accept ARPA funding.

- Vermont Municipal Clerks & Treasurers Association (VMCTA) Conference, September 21, 2022 - ARPA Fund Accounting presentation.

- Local ARPA General Information for Towns, Cities and Villages - June 2022 (editable PowerPoint format; PDF can be found HERE)

- Treasury's ARPA Reporting Data - View the actual data that was entered for Project & Expenditure Reports during the April 30, 2022 reporting to the U.S. Department of the Treasury. It includes Vermont's NEUs (non-entitlement units of government), metropolitan areas (Burlington and South Burlington), as well as the State of Vermont. All public reporting can be found on Treasury's "Recipient Compliance and Reporting" webpage (scroll almost to the bottom of the page).

- Vermont ARPA April 30, 2022

- Vermont ARPA April 30, 2023

- Vermont ARPA April 30, 2024

- Excel file for Vermont data HERE.

- Excel file for national data HERE.

- Dashboard (HERE) - To find information on Vermont's local governments select/filter for the following:

- Select "Projects" from the tabs at the top of the page.

- Filter for:

- State/Territory - Vermont

- Expenditure Category Group - All

- Expenditure Category - All

- Recipient Type - Local Government (filter for

- Recipient Report Tier - All (includes Burlington [Metro] and all others {NEUs])

- Recipient Name - All

-

ARPA State Fiscal Recovery Fund - Programs Available to Municipalities (Oct 2022)

-

Vermont Department of Finance and Management - COVID 19 Finance Related Guidance

-

Local Fiscal Recovery Payments. The State of Vermont will distribute ARPA Coronavirus Local Fiscal Recovery Funding (local and county dollars) using these allocations.

-

Certification Dashboard - Local Fiscal Recovery Fund Allocations - Find your NEU RECIPIENT NUMBER (shown as "Town ID") here!

-

State of Vermont Recovery Plan, State and Local Fiscal Recovery Funds Reports, as required by and submitted to U.S. Treasury.

- ICMA ARPA Local Fiscal Recovery Fund Spending Priorities Survey ICMA surveyed local government chief administrative officers (CAOs) in September 2021 about their priorities for utilizing the American Rescue Plan Act (ARPA)’s Local Fiscal Recovery Funds (FRF). Nearly 600 town, city, and county managers responded. Responses include local governments with populations ranging from less than 2,500 to over one million; two thirds came from communities of 25,000 or fewer residents, which fall under the U.S. Treasury definition of “Non-entitlement Units” (NEUs, i.e., local governments typically serving a population of under 50,000). Direct FRF recipients include counties and metropolitan citie

- National League of Cities COVID-19 Local Action Tracker (webpage) NLC and Bloomberg Philanthropies have teamed up to collect and share actions taken by local leaders in response to the COVID-19 Pandemic, including uses for ARPA funding.

- Housing Resources for Vermonters in Need (February 2022)

- ACCD Grant Opportunities Inventory Dec 2021 - Grant opportunities for your local businesses, and municipalities, both COVID specific as well as existing programs.

Framework